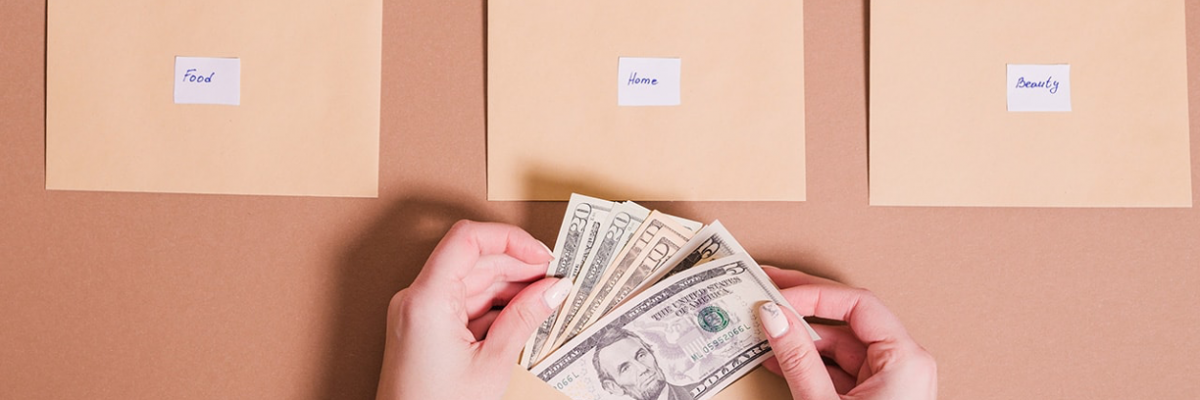

What is the Envelope System and is it Right for Me?

In this age of technology, the idea of the envelope system seems to have faded away. Which is a shame. The envelope system is a great way to take charge of your finances and is great if you’re just starting out or want to be more hands-on with your money. What is the Envelope System?

Read on